Saturn is currently going backwards at the end of Sagittarius. When a planet is going backwards (retrograde) it’s good to be thoughtful, and get things sorted for when the planet goes forwards again.

The most

well-known retrograde phenomenon is Mercury, which happens 3 times a year for 3

weeks at a time. It’s when things notoriously go wrong, particularly Mercurial

things like travel arrangements or vehicles or phones or paperwork. And it can

create a sense that the planets work in a fated way. But I think it’s more like

underlying problems get revealed, and if we pay attention to that, then we can

move forward again once the planet does. And if we aren’t thoughtful in that

kind of way, it will just seem like things are determined to go wrong.

I think

there IS a fated element that astrology reveals, in the sense that it is, say, next

month not this month that it is time to address certain things. But there is

also free will and neither contradicts the other, even though they seem to. It

is one of those apparent contradictions that is good to live with, it makes our mind

more flexible, more subtle, less inclined to need everything pinned down.

On a

collective level, thoughtfulness is an unusual quality. So collectively, we

usually have to learn things – if we do – the hard way. And I think we are

seeing this with Saturn in Sagittarius and the stock market. Sagittarius is a

sign that likes to expand, but if it does so under Saturn retrograde in that

sign, it points to inflation, a bubble, rather than genuine expansion, based on

underlying realities. At the same time, we have also had a square between

Jupiter and Pluto, and this leads to the same kind of problem.

--------------------

Ad Break: I offer skype astrology readings (£60 full reading, £40 for an update). Contact: BWGoddard1(at)aol.co.uk

---------------------

A report was

issued by one of the big financial bodies a few days ago, pointing out that we

had not dealt with the underlying debt problems that the financial crash of

2008/9 revealed. Western countries are just as indebted now as they were at

that time, and the response has been to keep interest rates very low, so that

debts can be serviced, rather than corporations and individuals going bust. But

it doesn’t address the underlying problem. Since then, this problem has spread

to the East. China now has high levels of debt as well.

|

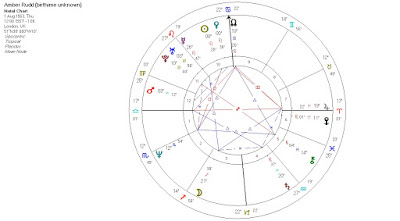

| DOW JONES 2012-17 |

This problem

of debt, combined with Saturn’s final days in Sagittarius, and the end of the

Jupiter-Pluto square, points to a correction to the stock market, which has had

a long bull run. In late August, Saturn will start to move forward into

Capricorn, and there is no stronger signature for a reality check than this. Saturn,

the planet of proportionality and rectitude and responsibility, in its own sign

of Capricorn.

It will also

point to the final economic outcome of the Uranus-Pluto square, which began at

the time of the 2009 crash, revealing the problems, problems which as I say we have

still not dealt with, only delayed.

As Saturn

enters Capricorn, it will begin to move towards a conjunction with Pluto in

that sign in 2½ years time. Not long. So the stock market check that is soon to

begin will not be temporary, it will be ushering in a major restructuring over

the next few years. In the UK, people are understandably fed up with austerity.

But we have been living beyond our means ever since the last Labour government

failed to control the banks, and was forced to bail them out at huge cost. Other

governments also failed in their job. But that doesn’t excuse our government,

and the Chancellor in the years leading up to it, Gordon Brown.

So there will

be a new economic order on its way as Saturn enters Capricorn and moves to

conjoin Pluto. Austerity is not yet over. The stock market will go down, and there may be a recession. These

things often happen in a panicky way. But overall I think it will be more of a significant

correction than a crash, because that is the nature of Saturn and Capricorn. And

the bubble is not huge: the Dow Jones is only about 25% higher than it was in

the bubble of 1999.